Which of the Following Best Describes Quantitative Risk Analysis

A method used to apply severity levels to potential loss probability of loss and risks C. Failure to communicate risks to all sectors of the project team and management.

Qualitative And Quantitative Risk Analysis What Is The Difference

Quantitative Risk Analysis We want exactly enough security for our needs.

. It documents all of the outcomes of the other risk management processes. Qualitative Risk Analysis. Focuses on all the risks identified in the identify risk process.

Failure to properly consider the likelihood and impact of potential risks. Quantitative Risk Analysis tools and techniques include but are not limited to. For example we might say that a risk has a 20 probability of occurring and if the risk occurs there would be a 10000 impact.

Three Point Estimate a technique that uses the optimistic most likely and pessimistic values to determine the best estimate. Up to 24 cash back effectively. Which of the following best describes the disadvantages of quantitative risk analysis compared to qualitative risk analysis.

According to Project Management Skills nd and Goodrich nd. Which of the following best describes the disadvantages of quantitative risk analysis com- pared to qualitative risk analysis. Quantitative risk analysis requires complex calculations and Quantitative risk analysis is more time-consuming than qualitative risk analysis.

Its a document that contains the initial risk identification entries. Describe the characteristics techniques and appropriate applications of both quantitative and qualitative risk analysis. In contrast with the qualitative risks analysis that allocates each risks.

Quantitative risk analysis assigns numerical values to risks and looks at those risks that are high on the list of prioritized risks during qualitative risk analysis. Quantitative risk provides clear answers to. An assessment of overall project risk exposure As part of carrying out the Perform Quantitative Risk Analysis process updates are made to the risk register.

Given this requirement which of the following concepts would assist the analyst in determining this value. What is Quantitative Risk Analysis. Simulation Techniques such as Monte Carlo Analysis.

Admin January 29 2019. Failure to continually perform system analyses to identify risks. Quantitative risk analysis relies on accurate statistical data to produce actionable insights the kind that hasnt been historically available.

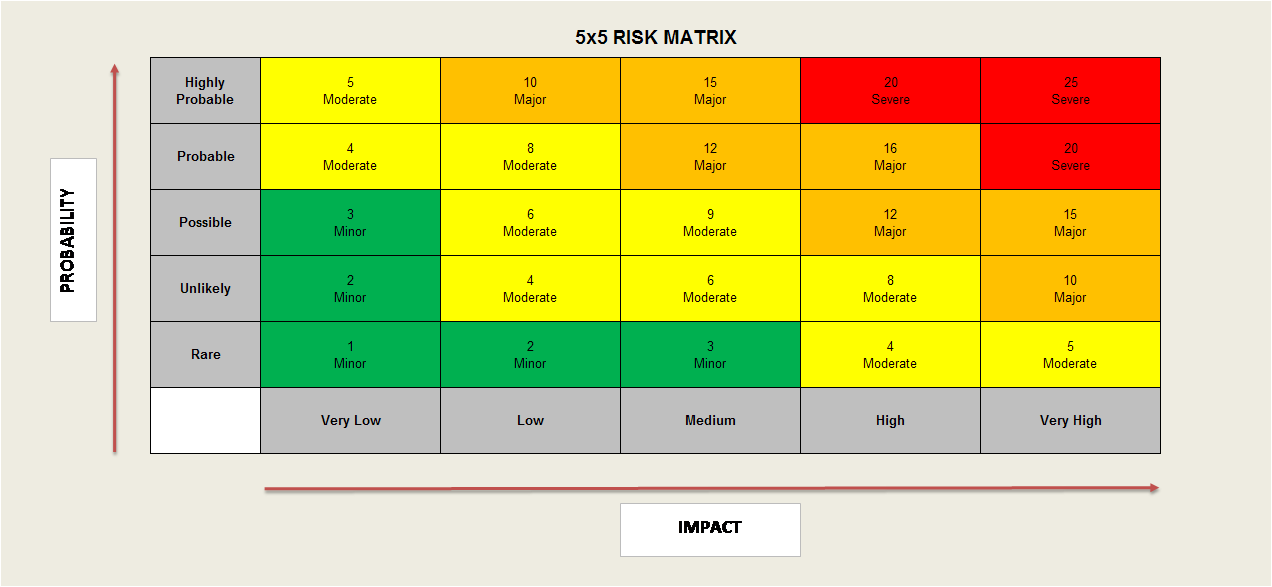

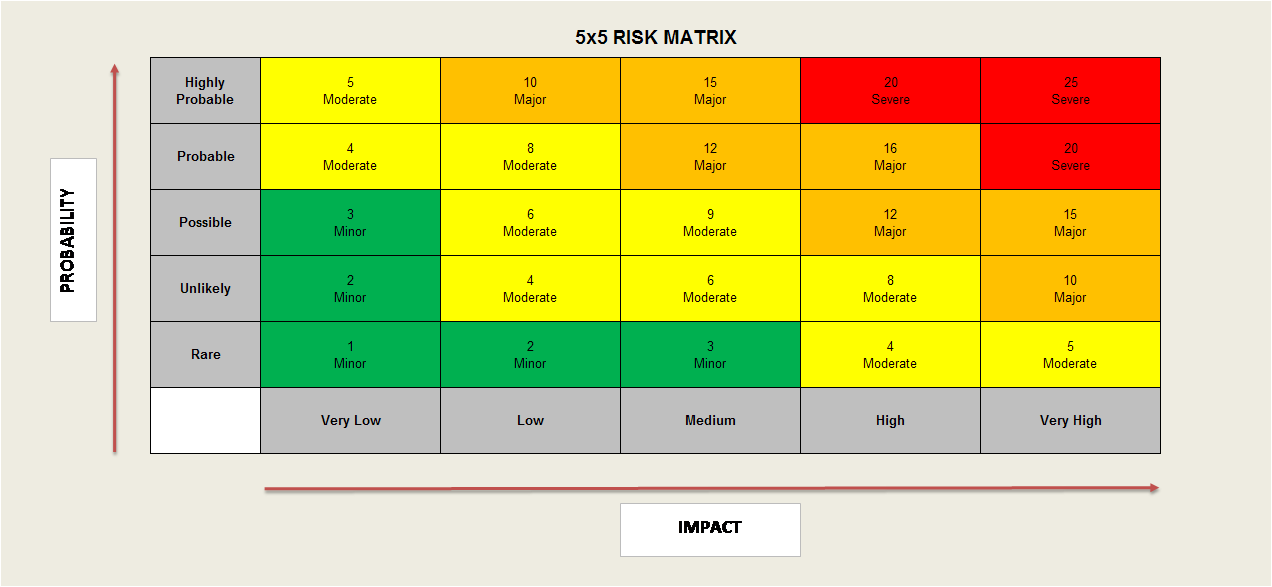

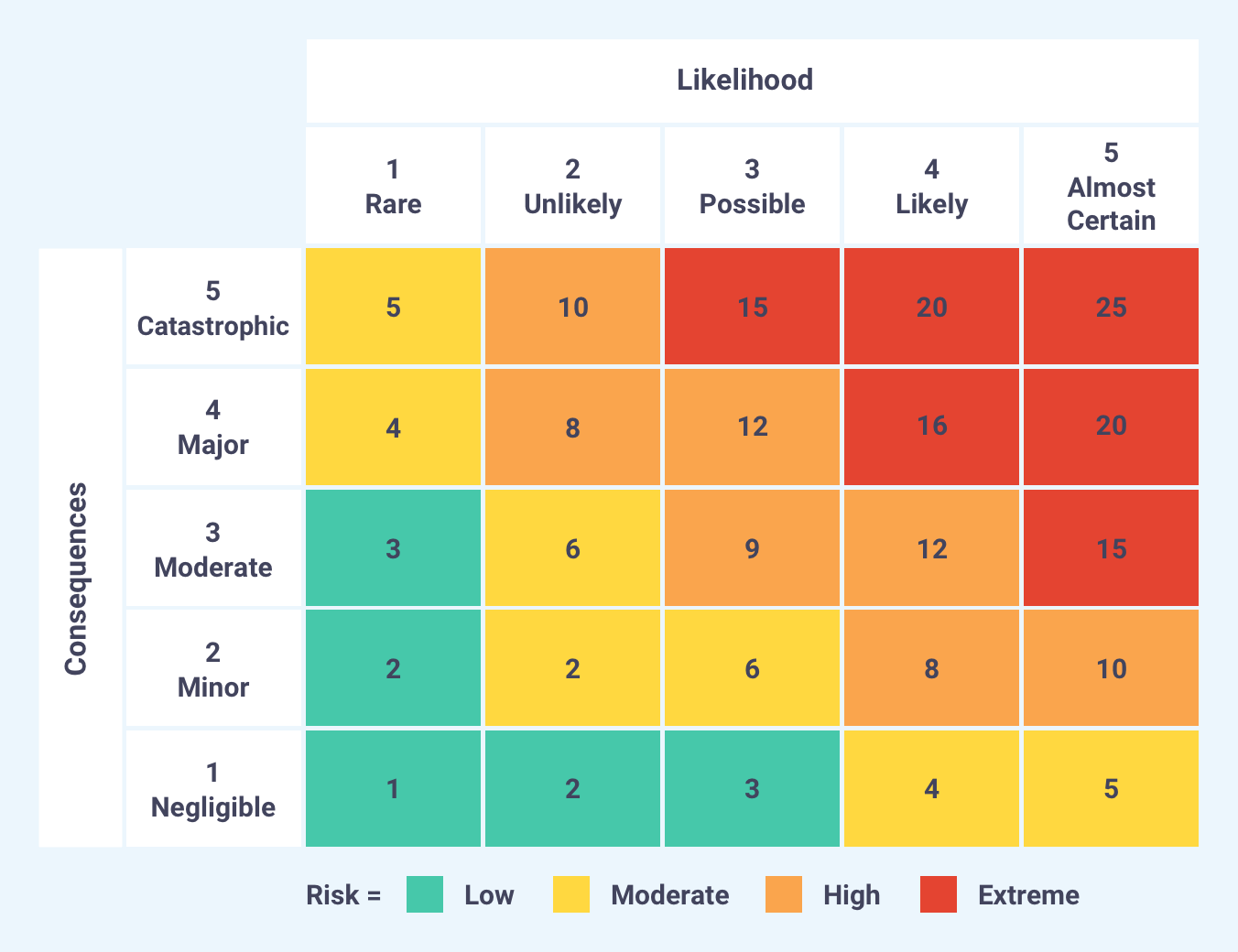

Quantitative risk analysis requires expertise on systems and infrastructure. Quantitative risk analysis requires detailed financial data. The risks are scored according to their.

Failure of the team and management to work to make trade-off decisions to mitigate risks. Calculate the value of the information or asset. We find the assets value.

The risk analysis should show the potential mon. Which of the following quantitative risk analysis techniques is used to determine which risks have the most powerful impact on the project with results displayed in the form of a tornado diagram. A security analyst is performing a quantitative risk analysis.

The risk analysis should show the potential monetary loss each time a threat or event o. This method is a numeric evaluation. Which of the following is a quantitative model typically used by a dss.

So while it might be quicker the best way to get the most robust risk analysis is through quantitative means. A method that assigns monetary values to components in the risk assessment D. When performing a quantitative risk analysis which of the following is MOST important to estimate the potential loss.

Focuses on all the risks that have a possibility and high impact on the project elements. So instead project managers used a more subjective qualitative approach to risk management. Exposure factor EF Percentage of Asset Value lost.

Which one of the following best illustrates a quantitative change in development. Quantitative risk analysis is the process of calculating risk based on data gathered. Which best describes a quantitative risk analysis.

Assess the impact of confidential data disclosure. Failure Mode and Effects Analysis FMEA b. Asset Value AV How much is the asset worth.

Among the updates are an assessment of overall project risk exposure and detailed probabilistic analysis of the project. Easy guide to learn how we can perform risk analysis in project management. The goal of this process is to quantify possible outcomes for the project determine probabilities of outcomes further identify high impacting risks and develop realistic scope schedule and cost targets.

How much of it is compromised how much one incident will cost how often the incident occurs and how much that is per year. Scales risks by using numbers 0-5 or percentages. C and D are incorrect because these ratings are part of quantitative-qualitative risk analysis.

This is achieved by using whats already known to predict or estimate an outcome. Explore the Difference between Quantitative and Qualitative Risk Analysis. Quantitative risk analysis assigns high-level values for probability and impact while qualitative risk analysis assigns specific values to probability and impact which are used to calculate a.

Which of the following best describes quantitative risk analysis. Quantitative risk analysis numerically assesses the overall effect of all identified project risks on project objectives. Does not use numerical methods.

Which of the following is an example of a quantitative observation. QUALITATIVE RISK ANALYSIS Qualitative risk analysis is a risk-level analysis conducted using rating scales. Which of the following is an example of quantitative data.

A method that is based on gut feelings and opinions. Quantitative risk analysis is sometimes subjective. Which one of the following best describes the risk register.

A scenario-based analysis to research different security threats B. The goal of quantitative risk analysis is to further specify how much will the impact of the risk cost the business. So what is quantitative risk analysis.

Decision Tree Analysis a diagram that shows the implications of choosing one or other alternativesClick here to see an example. Using the expected monetary value EMV method we could multiply the probability times the impact resulting in a 2000 risk exposure. Expected Monetary Value EMV c.

Measure the probability of occurrence of each threat.

What S The Difference Between Qualitative And Quantitative Risk Analysis

How To Link The Qualitative And The Quantitative Risk Assessment

Examples Of Quantitative Risk Calculations For Hazard Analysis Download Table

Comments

Post a Comment